Your Comprehensive Guide to Credit Card Mastery

February 9, 2025 | by arbindbodr@gmail.com

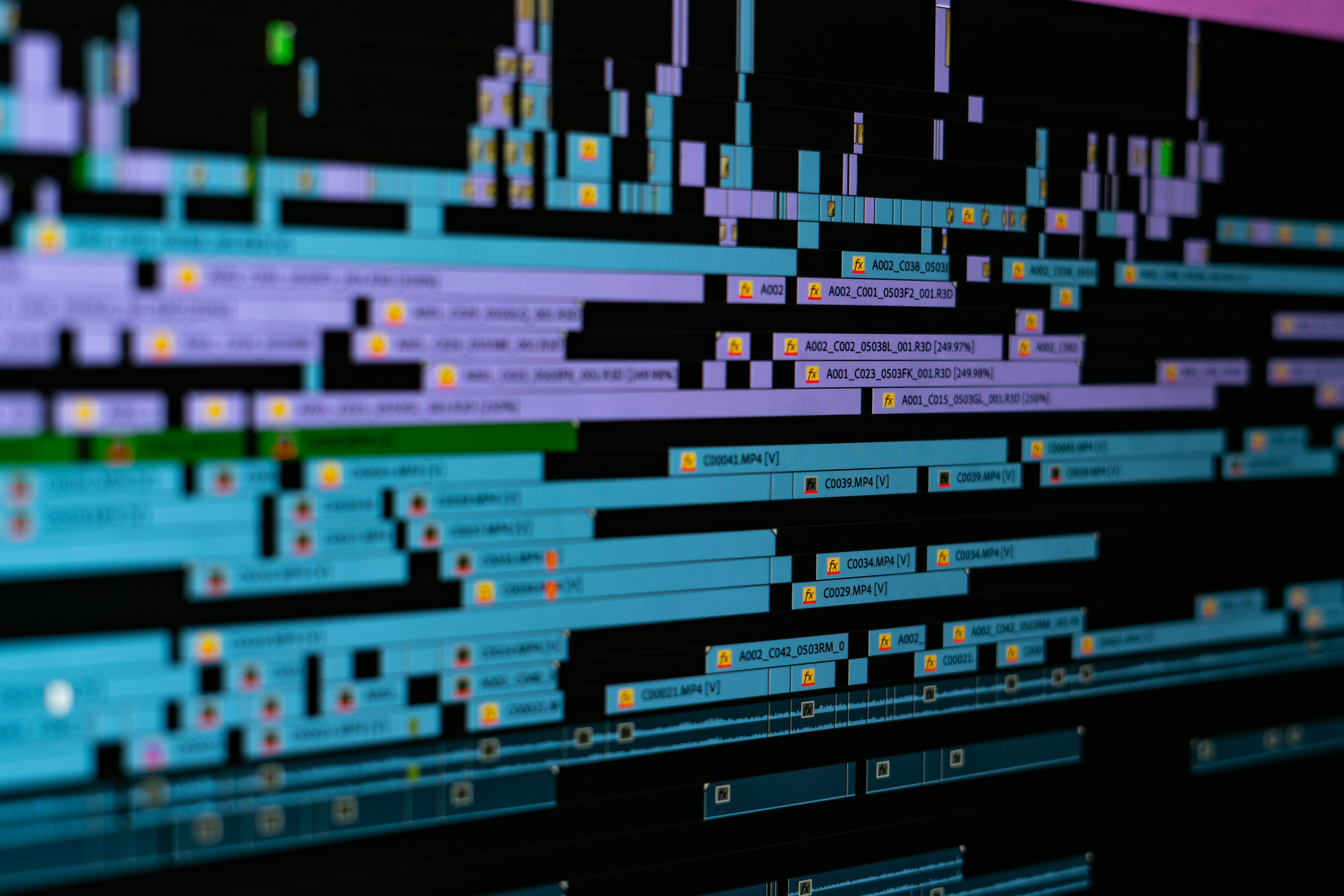

Photo by Mathieu Stern on Unsplash

Photo by Mathieu Stern on Unsplash Understanding the Diverse Landscape of Credit Cards

The credit card market today offers a myriad of options tailored to meet various spending habits and financial goals. The primary types of credit cards include rewards cards, cashback cards, travel cards, and balance transfer cards, each designed with unique features that can significantly impact your financial landscape. Rewards cards allow users to accumulate points for every dollar spent, which can later be redeemed for merchandise, gift cards, or even cash. This is particularly useful for individuals who tend to spend regularly in categories that earn bonus rewards.

Cashback cards offer another attractive option, providing a percentage of the spending back to the cardholder. With typical rates ranging from one to five percent, cashback cards are ideal for those who prefer direct savings on daily purchases. Furthermore, travel cards are structured to benefit frequent travelers by offering bonuses such as airline miles, free checked bags, and access to exclusive lounges. These rewards can significantly enhance the travel experience while simultaneously providing substantial monetary benefits.

When selecting a credit card, it is essential to consider factors such as interest rates, annual fees, and eligibility prerequisites. Credit cards with lower annual fees and competitive interest rates can provide better value over time. Understanding the terms and conditions associated with each card is crucial, as hidden fees and variable interest rates may offset any potential benefits. Assessing your spending habits and financial objectives can guide you in making an informed decision. For instance, those who travel frequently might prioritize travel rewards, while everyday users might benefit more from cashback options. Ultimately, the right credit card can be a powerful tool, aiding in enhancing your financial well-being and meeting personal objectives effectively.

Strategies for Responsible Credit Management

Managing credit cards effectively is crucial for maintaining a healthy credit score and ensuring financial stability. One of the best practices for responsible credit management is to pay off your balance in full each month. This approach not only prevents the accrual of interest but also demonstrates to creditors that you can manage your debt responsibly. Should paying the full amount be challenging, strive to pay at least the minimum due and consider making multiple payments throughout the month to keep your balance low.

Understanding your credit score is paramount. Your credit score, influenced by factors such as payment history, utilization ratio, and length of credit history, plays a significant role in your financial opportunities. Regularly monitoring your credit report helps identify any discrepancies or areas for improvement. Aim for a credit utilization ratio below 30%, as higher utilization can negatively affect your score. Reducing your overall debt and avoiding maxing out your cards will contribute positively to your credit profile.

To further enhance your credit management strategy, it is essential to be mindful of potential pitfalls. Common issues such as late payments, applying for too many credit accounts at once, and accumulating high-interest debt can quickly damage your credit score. Developing a budget that accounts for your credit card payments can help prevent overextending your finances. Additionally, understanding the terms and conditions of your card, including interest rates and fees, is vital for avoiding unexpected charges.

Maximizing the rewards and perks offered by credit cards can provide significant benefits when used wisely. Selecting a card that aligns with your spending patterns—such as cashback, travel rewards, or points—can enhance your overall financial health. Finally, staying updated with industry news and trends ensures you are informed about changing offers and can make the most appropriate credit card choices for your circumstances.

RELATED POSTS

View all